Half-yearly financial report

for the six months ended 30 September 2016

1 Excludes other items being £107.1m impairment of goodwill, £10.1m write off of acquisition related intangible assets, £6.0m restructuring

costs and £4.9m acquisition related item (HY16: £5m) see note 3 to the condensed consolidated financial statements.

Financial performance and key indicators

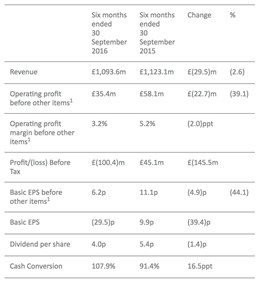

- Operating profit before other items of £35.4m (HY16: £58.1m)

- The board has decided to withdraw from the domiciliary healthcare market and has placed the group’s domiciliary healthcare business under strategic review. Our healthcare businesses will continue to fulfil all obligations but there will be no investment in new areas of this market. Mitie will manage its withdrawal in an orderly and responsible manner. The board has changed its long-term view of this market. All healthcare goodwill and intangibles have been written off

- Loss before tax of £(100.4)m (HY16:£45.1m) is stated after other items of £128.1m, including full impairment and write off of Healthcare goodwill and acquisition-related intangible of £117.2m and restructuring costs of £6.0m

- Dividend declared at 4.0p (HY16: 5.4p) (1.6x cover; HY16: 2.1x cover)

- Rolling 12 month cash conversion of 107.9% (HY16: 91.4%)

- Net debt at 30 September 2016 was £231.7m or 1.9 x EBITDA (HY16: £221.8m or 1.5x EBITDA)

- Healthy sales pipeline at £9.3bn (March 2016: £9.1bn) and order book at £7.7bn (March 2016: £8.5bn)

- 94% of 2016/17 budgeted revenue secured (HY16: 97%) and 65% of 2017/18 forecast revenue secured (HY16: 68%)

Progress in H1

- As stated in our September trading update, performance in the first half of the year has been impacted by changing market conditions as clients adjust to rising labour costs and economic uncertainty.

- Short term reductions in higher margin project work and discretionary spend have reduced profits in Facilities Management as clients adjust to rising labour costs and macroeconomic conditions with weak UK business confidence affecting client investment plans

- Long-term strength and quality of Mitie’s services was reinforced by the award of new contracts with Manchester Airports Group, Manchester health and justice partners, Network Rail, and the Scottish Police Authority and Scottish Fire Rescue Service – valued in excess of £170m over the terms of the contracts.

- Award of Mitie’s largest security contract with Sainsbury’s valued at an incremental £115m over three years underlines the opportunities for our risk based technology approach

- Local government and housing association funding constraints have delayed contract awards in Property Management causing revenue and profit decline

- Downward pressure on homecare charge rates and a reduction in care volumes has resulted in increased Healthcare losses

Board changes

- As previously announced as a part of our long-term board succession plans, Ruby McGregor-Smith will step down as chief executive on December 12, 2016 after almost ten years in the role and will be replaced by Phil Bentley

Outlook

- Improved performance is expected in the second half of the year due to enhanced revenue visibility from new contract awards and retentions, momentum in levels of project work and the anticipated incremental H2 benefits from restructuring programmes of £10m compared to H1

- Despite this progress, due to ongoing market uncertainties, underlying earnings for FY17 are expected to be below management’s previous expectations

- The quality of the business, our people, our long-term client relationships and having no material rebids until 2019, gives us confidence for the performance of Mitie in the years ahead

Ruby McGregor-Smith CBE, Chief Executive of Mitie, commented:"The first half of this year has been difficult but we are not alone in facing significant macroeconomic challenges. The steps we have taken to counter these impacts include the restructuring of both frontline and support functions across FM and the decision to withdraw from the domiciliary care market. Second half performance is expected to improve with our new operating model as we adapt to market conditions.

"As I step down as CEO I would like to thank everyone at Mitie who has helped make this such an extraordinary place to work. Thank you also to our clients for their support over the past decade. Mitie is a great business and I am confident that it will move from strength to strength in the future.”

Roger Matthews, Chairman of Mitie, said:

“I would like to thank Ruby for the significant contribution that she has made to Mitie over her 14 years on the board, the last 10 years as CEO. Under her strong and passionate leadership our FM business has been transformed with the ability to provide a broad range of services to our blue-chip client base. I wish her every success for the future. I am delighted that Phil Bentley has joined Mitie as our future CEO. Phil has demonstrated his leadership skills and strong customer focus at both Cable & Wireless and British Gas and he has an excellent track record of delivering shareholder value.”

Mitie will be presenting its interim results for the period ended 30 September 2016 at 09.30 on Monday 21 November 2016. A live webcast of the presentation will be available online at www.mitie.com/investors at 09.30. The recorded webcast of the presentation and a copy of the accompanying slides will also be available on our website later in the day.

Legal disclaimer

This announcement contains forward-looking statements. Such statements do not relate strictly to historical facts and can be identified by the use of words such as ‘anticipate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, and ‘believe’ and other words of similar meaning in connection with any discussion of future events. These statements are made by the Directors of Mitie in good faith based on the information available to them as at 23 November 2015 and will not be updated during the year. These statements, by their nature, involve risk and uncertainty because they relate to, and depend upon, events that may or may not occur in the future. Actual events may differ materially from those expressed or implied in this document and accordingly all such statements should be treated with caution. Nothing in this document should be construed as a profit forecast.Except as required by law, Mitie is under no obligation to update or keep current the forward-looking statements contained in this report or to correct any inaccuracies which may become apparent in such forward-looking statements.

High resolution images are available for the media to download free of charge from www.flickr.com/Mitie_group_plc