Mitie Group plc

Half-yearly financial report for the six months ended 30 September 2014

Strong performance in our core business

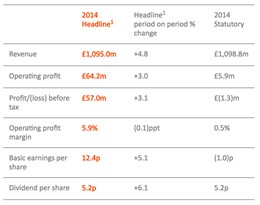

- Headline revenue growth of 4.8%, of which 3.9% was organic

- Headline operating profit up 3.0% (2.2% organic) and operating profit margin remains strong at 5.9%

- Headline cash conversion of 80.3%2 (2013: 106.7%) and statutory cash conversion of 128.6% (2013: 116.3%); above target KPI of 80%

- Net debt at 30 September 2014 of £233.8m or 1.5x headline EBITDA3 (2013: £221.8m, 1.5x headline EBITDA)

- Strong growth of both headline basic EPS and dividend, up 5.1% and 6.1% respectively

Strong organic growth in our Facilities Management business

- Sector leading organic FM revenue growth of 6.3% and contract retention rate above 90%

- Rated as the top overall service provider* in the UK FM industry for the second year running

- Successful in retaining our integrated FM contract with Vodafone for a further five years, valued at £250m

- Awarded a range of new FM contracts including with Royal Cornwall Hospitals valued at £90m over seven years and Heathrow Airport valued at £40m over three years

- Successfully mobilised our contract with the Home Office to run two immigration centres at Heathrow, in a contract valued at £180m over eight years

- Property Management division will have a more buoyant second half, supported by planned project works

- Challenging first half in our Healthcare division, however we remain confident of the long-term growth prospects in this market

Exit from loss-making businesses complete this financial year

- The exit from our mechanical and electrical engineering construction business will be complete in this financial year; losses of £6.9m incurred in the period and we expect this to range between £11m and £15m for the full year (FY2014: £13.6m)

- We have assessed all remaining risk on the design and build contracts left in our Asset Management business; exceptional charges of £45.7m incurred (FY2014: £25.4m), which cover all balance sheet exposures and all material expected future costs

- Beyond these amounts, we expect no further exceptional charges from either of these businesses

Well positioned for the long-term

- Order book remains healthy and now stands at £8.5bn (March 2014: £8.7bn); 98% of 2014/15 budgeted revenue secured (prior year: 99%) and 72% of 2015/16 forecast revenue secured (prior year: 74%)

- Bid pipeline has grown by 20% to £9.8bn (March 2014: £8.2bn) and continued investment being made in the bidding, strategic sales and operational management capability across the group

- Robust balance sheet and strong financial position will support growth

Ruby McGregor-Smith CBE, Chief Executive of Mitie, commented:

“We have delivered a strong performance in our facilities management business during the first half of the year, and we expect to gain further positive momentum through the rest of the year.

“We have significantly de-risked our group by finalising the exit from our loss-making businesses. We are focused on investing in and maximising the long-term growth potential of our facilities management, property management and healthcare businesses.

“Our order book and sales pipeline are substantial. We are in a good position to deliver growth and look ahead with confidence.”

1 Headline results exclude other items. Other items comprise exceptional charges in relation to design and build contracts in Energy Solutions of £45.7m (2013: £nil), acquisition related and integration costs of £0.6m (2013: £2.6m) and the amortisation of acquisition related intangible assets of £5.1m (2013: £5.6m). They also include the results of the mechanical and electrical engineering construction business, with revenue of £3.8m (2013: £41.2m) and a trading loss of £6.9m (2013: £4.3m loss).

2 Headline cash conversion, calculated on a rolling 12-month basis, excludes the cash effect of other items.

3 12-month rolling EBITDA

* i-FM brand survey

Mitie will be presenting its interim results for the period ended 30 September 2014 at 09.30 on Monday 17 November 2014. A live webcast of the presentation will be available online at www.mitie.com/investors at 09.30. The recorded webcast of the presentation and a copy of the accompanying slides will also be available on our website later in the day.

Legal disclaimer

This announcement contains forward-looking statements. Such statements do not relate strictly to historical facts and can be identified by the use of words such as ‘anticipate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, and ‘believe’ and other words of similar meaning in connection with any discussion of future events. These statements are made by the Directors of Mitie in good faith based on the information available to them as at 17 November 2014 and will not be updated during the year. These statements, by their nature, involve risk and uncertainty because they relate to, and depend upon, events that may or may not occur in the future. Actual events may differ materially from those expressed or implied in this document and accordingly all such statements should be treated with caution. Nothing in this document should be construed as a profit forecast.

Except as required by law, Mitie is under no obligation to update or keep current the forward-looking statements contained in this report or to correct any inaccuracies which may become apparent in such forward-looking statements.

High resolution images are available for the media to download free of charge from www.flickr.com/Mitie_group_plc